Short Synopsis

Claim Map

Amalgamation of West End Mining Company and Tonopah Extension Mining Company. This property represents the 3rd largest producer in the district.

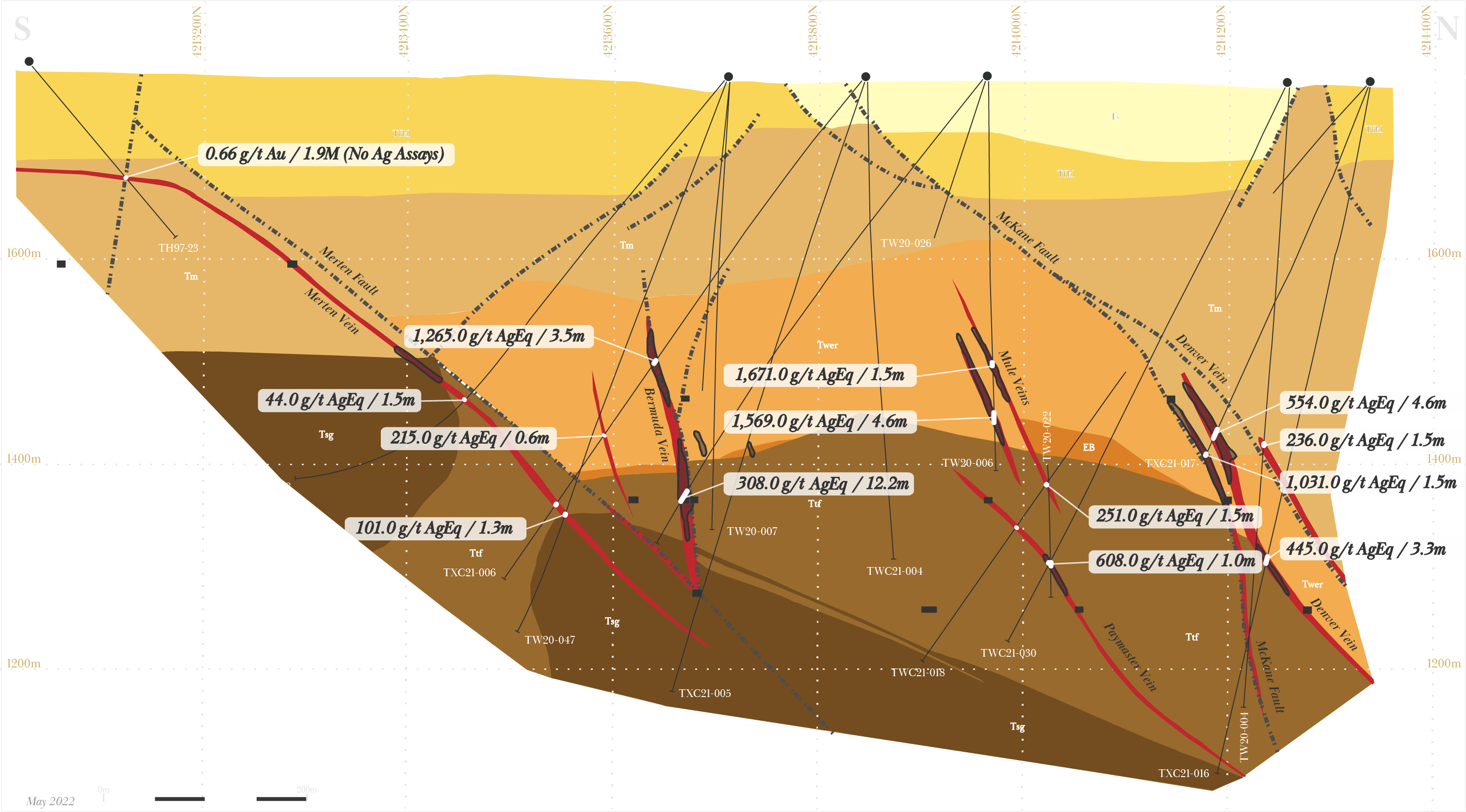

Cross Section - DPB Area

Multiple high-grade quartz vein swarm trending east-west to northwest.

System is open to the northwest with multiple new high-grade intercepts 1 km away.

Click image to expand

Cross Section - Victor Area

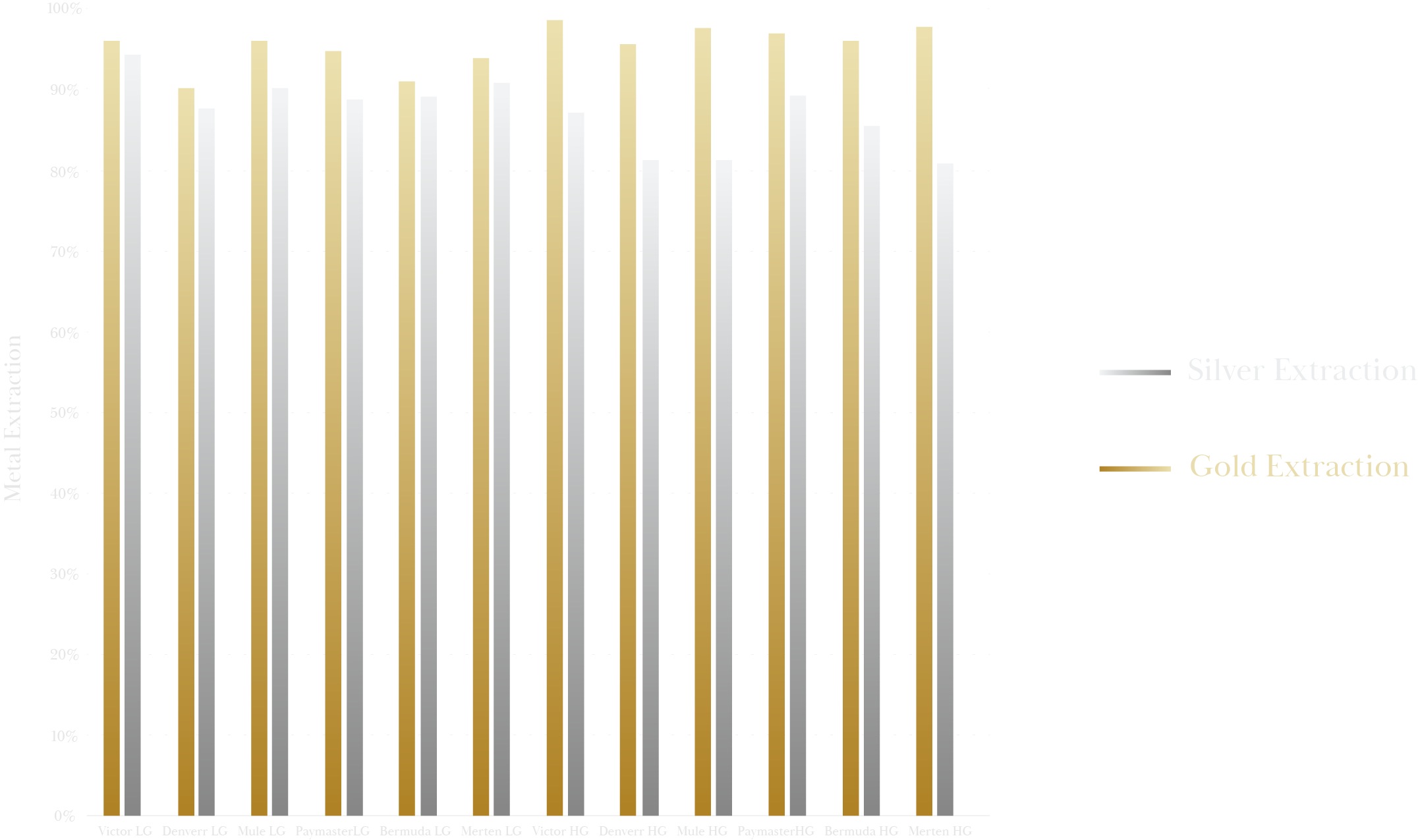

Silver Equivalent grade is based on silver and gold prices of US$20/ounce and US$1750/ounce,

respectively, and recoveries for silver and gold of 87% and 95%, respectively

Click image to expand

*All historic production information from Nevada Bureau of Mines & Geology, Bulletin 51 Bulletin 92. US short tons have been converted to metric tonnes by multiplying short tons by 0.9072 AuEq = (historic silver production times historic silver price) divided by historic gold price) plus historic gold production AgEq = (historic gold production times historic gold price) divided by historic silver price) plus historic silver production.

**Technical information relating to the Tonopah West Project is based on and derived from the NI 43 101 report prepared for Blackrock entitled “Technical Report and Estimate of Mineral Resources for the Tonopah West Silver Gold Project, Nye and Esmeralda Counties, Nevada, USA” effective April 28, 2022 (the “Technical Report”). AgEq equivalent grade is based on silver and gold prices of US$20/ounce and US$1750/ounce, respectively, and recoveries for silver and gold of 87% and 95%, respectively.

***Source: S&P Global; Company reports as of December 28, 2022. AgEq resources and grade reflect only silver and gold (M&I and I) resources (excludes base metals) for deposits larger than 40 million ounces AgEq

*****See news release dated January 10,2023

***** See news release dated December 7, 2022