Blackrock’s flagship Tonopah West project consolidates the western half of the famed Tonopah Silver District within the Walker Lane trend of Nevada. Known as the Queen of the Silver Camps, the Tonopah Silver District produced over 174 million ounces of silver and 1.8 million ounces of gold from approximately 7.5 million tonnes of material, making it the second largest historic silver district within the “Silver State” of Nevada behind the Comstock Lode. Black Rock is the first group to target the historic workings on the property since production shut down nearly 100 years ago due to low metals prices at the onset of the Great Depression.

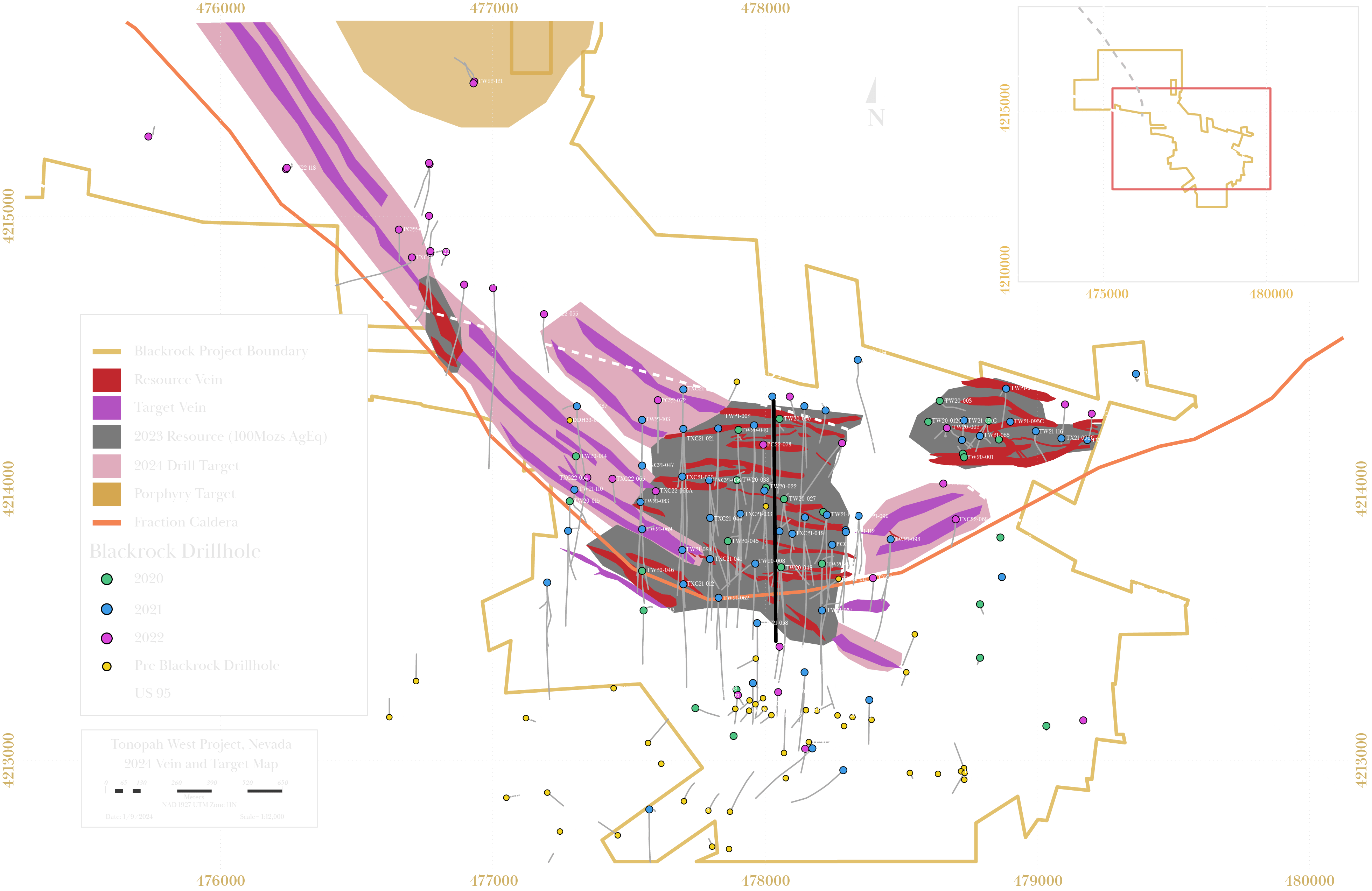

We have since drilled out over 4 kilometres of vein extensions from where the old timers left off, bringing new life to this storied district, with the system remaining wide open for further exploration. A maiden mineral resource estimate was delivered in 2022 that incorporated 125,000 metres of drilling by Blackrock that established Tonopah West as one of the highest-grade undeveloped silver projects in the industry.

Intermediate Sulfidation Epithermal Gold & Silver Veins

Blackrock Silver’s Tonopah West project geologic model from our 2023 resource update

Pictured in yellow is the vein system as modeled. The magenta is the high-grade #ilver and gold model, with silver above 150 g/t and gold above 2 g/t. The magenta corresponds to the reported MRE of 6.12 Mtonnes grading 509 g/t AgEq for 100Moza AgEq. The blue line and bowl represents the approximate location of the Fraction caldera, the main geologic control for the vein corridor. The pink cone is an intrusive we encountered in core hole TXC22-051 which may be the driver of the silver and gold system, which we intend to follow up on to understand its role in the mineralization of the Tonopah silver district.

Resources

| Area | AgEq cutoff g/t (1) | Tonnes | Silver g/t | Gold g/t | AgEqg/t (2) | Ounces of Silver | Ounces of Gold | Ounces of Silver Equivalent(3) | Classification(4) |

| Victor | 200 | 2,193,000 | 262.2 | 3.11 | 547.4 | 18,484,000 | 219,000 | 38,589,000 | Inferred |

| DP | 200 | 1,592,000 | 194.8 | 2.63 | 435.9 | 9,970,000 | 134,000 | 22,305,000 | Inferred |

| Bermuda | 200 | 1,360,000 | 298.8 | 3.53 | 623.4 | 13,063,000 | 154,000 | 27,250,000 | Inferred |

| NW Step Out | 200 | 976,000 | 198.3 | 1.97 | 379.2 | 6,220,000 | 62,000 | 11,894,000 | Inferred |

| TOTAL | 6,119,000 | 242.6 | 2.90 | 508.5 | 47,738,000 | 570,000 | 100,038,000 | Inferred | |

1 AgEq cutoff grade is based a total mining, processing and G&A cost of $119/tonne.

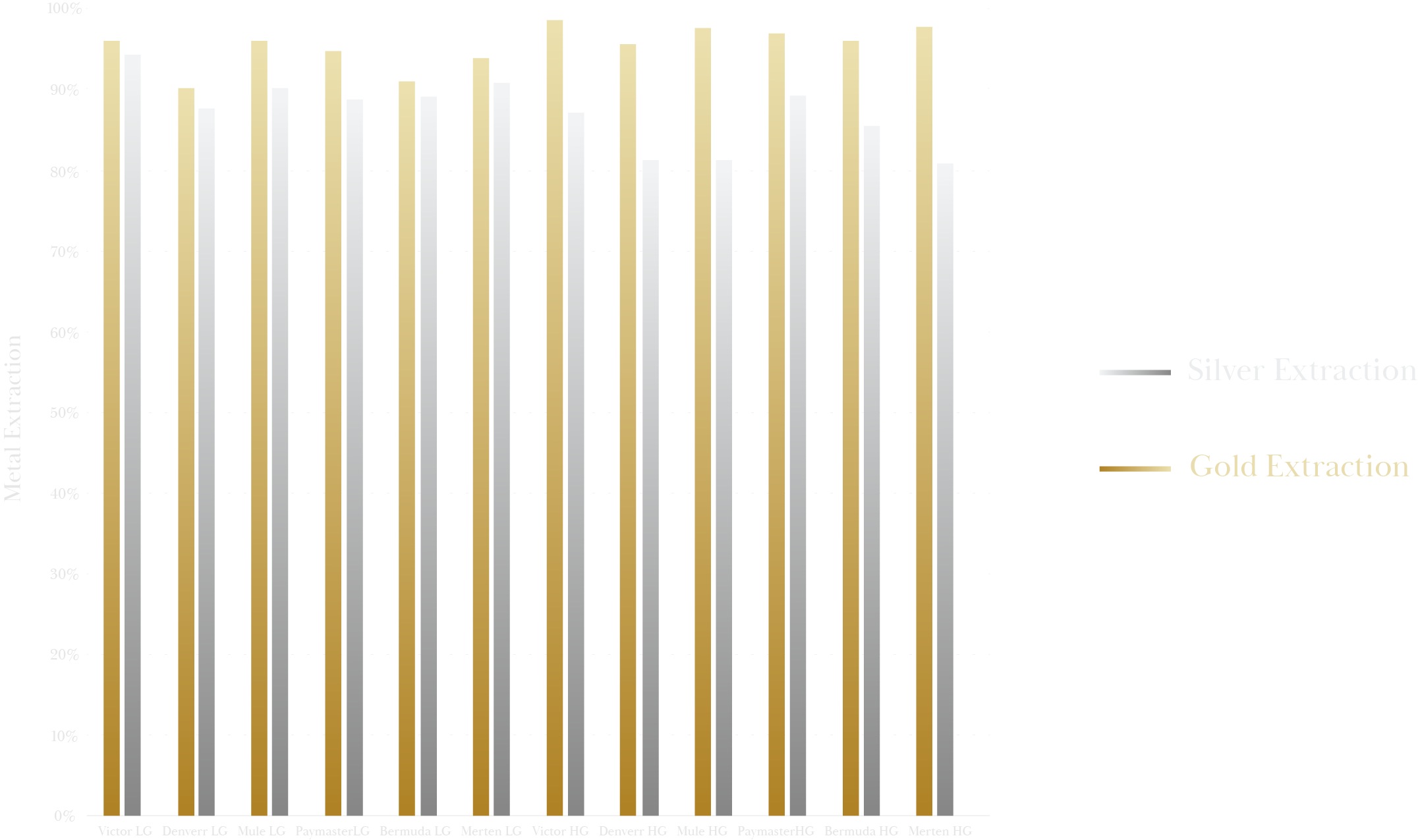

2 Silver Equivalent grade ratio used in this news of 84:1 is based on silver and gold prices of $22/ounce and $1,850/ounce, respectively, and recoveries for silver and gold of 87% and 95%, respectively. AgEq Factor= (Ag Price / Au Price) x (Ag Rec / Au Rec); g AgEq/t = g Ag/t + (g Au/t / AgEq Factor).

3Rounding as required by reporting guidelines may result in apparent discrepancies between tonnes, grade, and contained metal content.

4 Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources estimated will be converted into mineral reserves. The quantity and grade of reported Inferred mineral resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred mineral resources as Indicated mineral resources. It is uncertain if further exploration will result in upgrading them to the Indicated mineral resources category.

Claim Map

Amalgamation of West End Mining Company and Tonopah Extension Mining Company. This property represents the 3rd largest producer in the district.

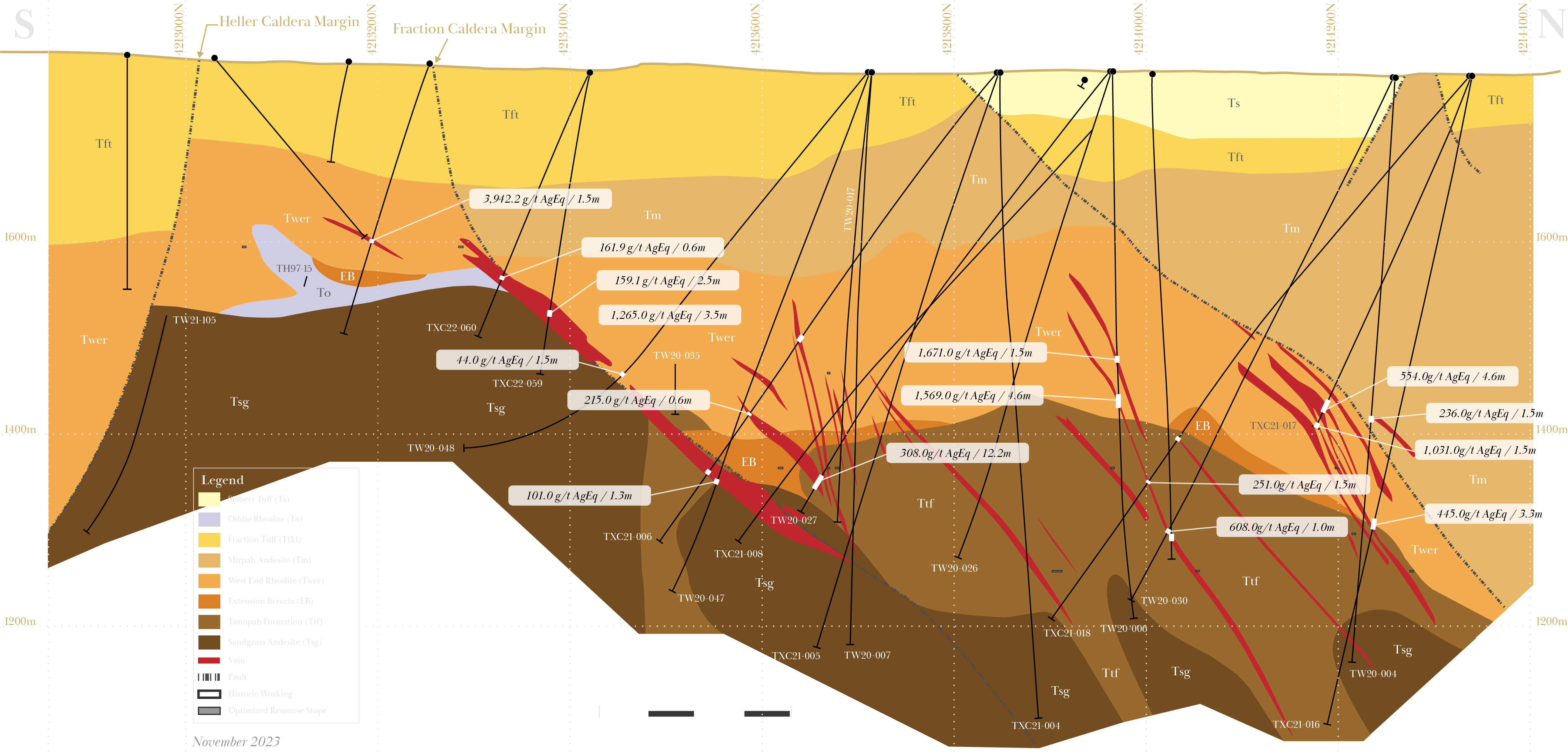

Cross Section - DPB Area

Multiple high-grade quartz vein swarm trending east-west to northwest.

System is open to the northwest with multiple new high-grade intercepts 1 km away.

Click image to expand

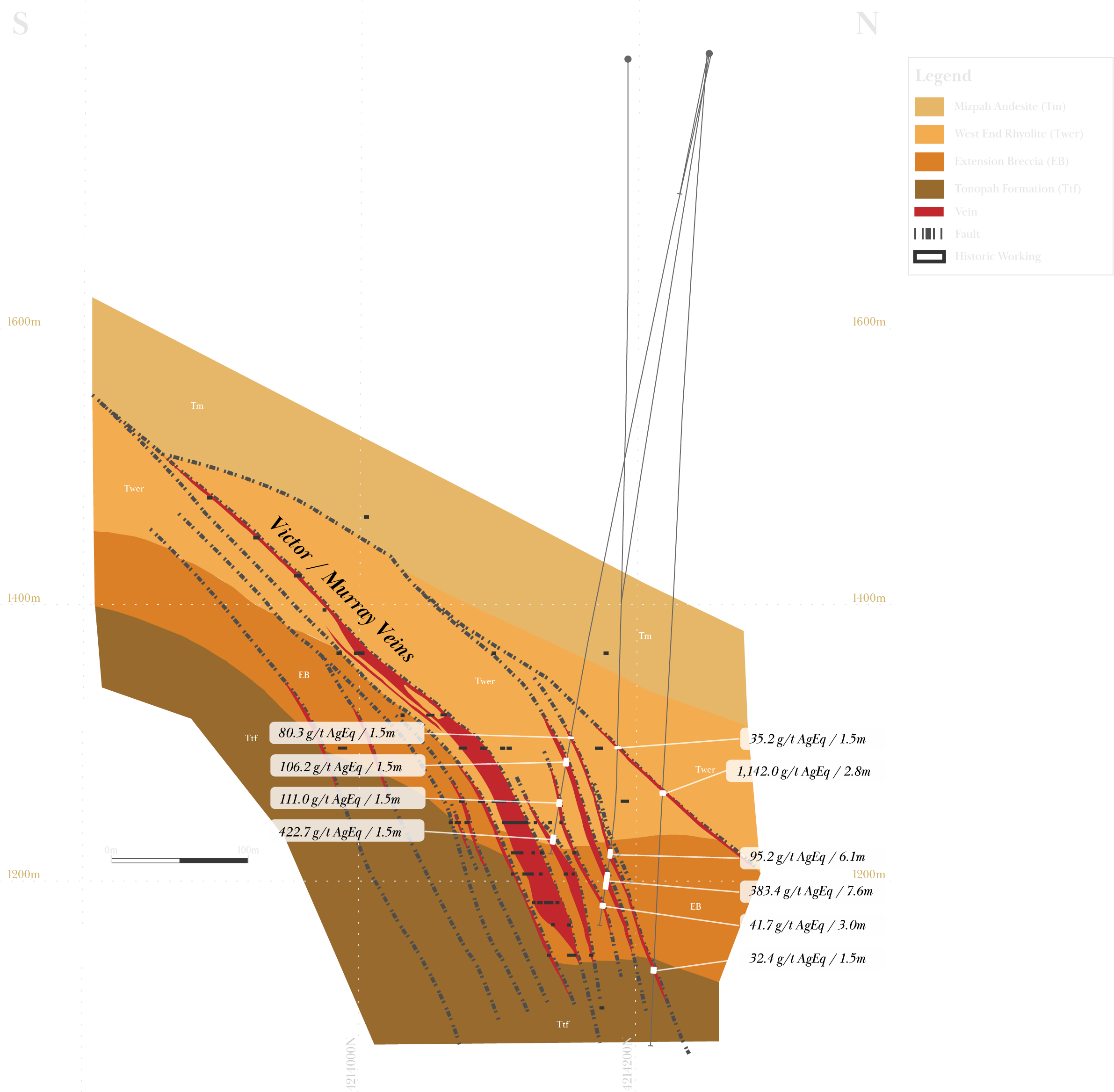

Cross Section - Victor Area

Silver Equivalent grade is based on silver and gold prices of US$20/ounce and US$1750/ounce,

respectively, and recoveries for silver and gold of 87% and 95%, respectively

Click image to expand

I, Jeffrey Bickel, C.P.G. (AIPG) and Registered Geologist (Arizona), consent to the public filing of the technical report titled “Technical Report for Updated Estimate of Mineral Resources, Tonopah West Silver-Gold Project, Nye and Esmeralda Counties, Nevada, USA”, with an effective date of October 6, 2023 and dated November 8, 2023 (the “Technical Report”) prepared for Blackrock Silver Corp. (the “Company”).

I also consent to any extracts from or a summary of the Technical Report in the news releases of the Company dated October 10, 2023 and November 8, 2023 (collectively, the “News Releases”).

I certify that I have read the News Releases filed by the Company and that they fairly and accurately represent the information in the Technical Report.

Dated this 8th day of November, 2023

“Jeffrey Bickel”//Sealed and Stamped

Jeffrey Bickel, C.P.G. (#12050)