Blackrock’s flagship Tonopah West project consolidates the western half of the famed Tonopah Silver District within the Walker Lane trend of Nevada. Known as the Queen of the Silver Camps, the Tonopah Silver District produced over 174 million ounces of silver and 1.8 million ounces of gold from approximately 7.5 million tonnes of material, making it the second largest historic silver district within the “Silver State” of Nevada behind the Comstock Lode.

Intermediate Sulfidation Epithermal Gold & Silver Veins

Tonopah West: Developing America’s Next Silver Mine

- Updated 2024 mineral resource estimate outlines an inferred 6.35M tonnes at block diluted grade of 492.5 g/t AgEq for 100.56M ounces AgEq

- Low Cost/Robust Production: PEA outlines 8.6M AgeQ ounces annually at $11.96 AISC; After-tax IRR 39.2%; After-tax NPV5 of $326M at $1,900 gold & $23 silver; Payback 2.3 years *

- At $2,280 gold & $27.60 silver after-tax NPV5 escalates to $495M and 54% after-tax IRR*

- Head Grade of 570 g/t AgEq. Highest-grade development staged silver project globally by over 50%*

- Very Straightforward Metallurgy: average 96.1% gold and 88.9% silver;. All Precious Metals/No Base. Standard Milling/Dore: no concentrates or smelters required.

- Private Land in Nevada: Project comprised of patented mining claims, owned by the Company , directly off a highway, adjacent to the town of Tonopah.

- Fully-funded resource expansion & conversion drilling program underway leading to Resource Update Q3 2025 & Updated PEA Q1, 2026; Assays pending

- Environmental studies and data collection underway to de-risk and advance project towards permitting of an exploration decline and bulk sampling program

- Updated 2025 mineral resource estimate outlines 21.1M AgEq ounces Indicated within 1.33M tonnes at a block diluted grade of 493 g/t AgEq AND 86.88M AgEq ounces Inferred within 5.14M tonnes at a block diluted grade of 523 g/t AgEq

- Low Cost/Robust Production: PEA based on 2024 MRE outlines 8.6M AgeQ ounces annually at $11.96 AISC; After-tax IRR 39.2%; After-tax NPV5 of $326M at $1,900 gold & $23 silver; Payback 2.3 years *

- At $2,280 gold & $27.60 silver after-tax NPV5 escalates to $495M and 54% after-tax IRR*

- Head Grade of 570 g/t AgEq. One of the highest-grade development-staged silver projects globally.

- Very Straightforward Metallurgy: average 96.1% gold and 88.9% silver;. All Precious Metals/No Base. Standard Milling/Dore: no concentrates or smelters required.

- Private Land in Nevada: Project comprised of patented mining claims, owned by the Company , directly off a highway, adjacent to the town of Tonopah.

- Fully-funded resource expansion & conversion drilling program underway leading to Resource Update Q3 2025 & Updated PEA Q1, 2026; Assays pending

- Environmental studies and data collection underway to de-risk and advance project towards permitting of an exploration decline and bulk sampling program

Blackrock Silver’s Tonopah West project geologic model from our 2023 resource update

Pictured in yellow is the vein system as modeled. The magenta is the high-grade silver and gold model, with silver above 150 g/t and gold above 2 g/t. The magenta corresponds to the reported MRE of 6.12 Mtonnes grading 509 g/t AgEq for 100Moza AgEq. The blue line and bowl represents the approximate location of the Fraction caldera, the main geologic control for the vein corridor. The pink cone is an intrusive we encountered in core hole TXC22-051 which may be the driver of the silver and gold system, which we intend to follow up on to understand its role in the mineralization of the Tonopah silver district.

2024 Preliminary Economic Assessment

Highlights of the Tonopah West PEA

- At the base case gold price of $1,900 per ounce and silver price of $23 per ounce, the Project commands an after-tax net present value discounted at 5% (“NPV5%”) of $326-million on a low initial capex of $178-million (including $22-million contingency) with a payback of 2.3 years and an after-tax internal rate of return (“IRR”) of 39.2%

- At a gold price of $2,280 per ounce and a silver price of $27.60 per ounce (base case +20%), the economic profile of the Project escalates to an after-tax NPV5% of $495-million and an after-tax IRR of 54.0%.

- All-in Sustaining Costs (“AISC”)1 of $11.96 per silver equivalent ounce basis.

- Over the approximately 8-year life of mine (“LOM”), production from the mining and processing of approximately 4.1 million diluted tonnes of material containing 75.4 million silver equivalent (“AgEq”) ounces (silver/gold ratio of 90/1) which equates to 66.8 payable AgEq ounces. The mine is expected to deliver 424,000 payable gold ounces and approximately 31.8 million payable silver ounces generating $496-million after-tax LOM cash flow.

- Tonopah West is situated on patented mineral claims (private land) and benefits from a stream-lined permitting process with only State and County regulators involved.

- The PEA is based on an updated Mineral Resource Estimate (“MRE”) with an effective date of August 23, 2024, comprising 6.35 million tonnes grading 2.82 grams per tonne (“g/t”) gold (“Au”) and 237.8 g/t silver (“Ag”) totaling 577,000 ounces of gold and 48.5 million ounces of silver. At a AgEq grade of 492.5 g/t AgEq, the Inferred Resources in the updated MRE represent a total of 100.56 million AgEq ounces.

- Recoveries of 96.1% for gold and 88.9% for silver from a 3-stage crushing circuit and processing plant.

- The Project incorporates local contract mining and is expected to stimulate the local economy, benefitting the municipality of Tonopah and surrounding communities through direct and indirect employment at the Project, local sourcing of services and supplies and community programs funded by the Company.

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative, geologically, to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

*See Tonopah West Technical Report filed on the Company’s SEDAR+ profile at www.sedarplus.ca and the Company’s September 4, 2024 news release

Key Economic Parameters of the PEA

Resources

| AgEq cutoff g/t (1) | Tonnes | Silver g/t | Gold g/t | AgEq g/t (2) | Ounces of Silver | Ounces of Gold | Ounces of AgEq(3) | Classification(4) |

| 180 | 1,333,000 | 220.7 | 2.50 | 493.2 | 9,459,000 | 107,000 | 21,139,000 | Indicated |

| 180 | 5,138,000 | 215.1 | 2.85 | 525.9 | 35,536,000 | 470,000 | 86,880,000 | Inferred |

1 AgEq cutoff grade is based a total mining, processing and G&A cost of $129/tonne (see Table 2).

2 Silver Equivalent grade ratio used in this news release is 100:1 which is based on silver and gold prices of $27/ounce and $2,700/ounce, respectively, and recoveries for silver and gold of 87% and 95%, respectively. AgEq Factor= (Ag Price / Au Price) x (Ag Rec / Au Rec) or ($27/$2700) x (0.87/0.95) = 0.009158; g AgEq/t = g Ag/t + (g Au/t / AgEq Factor).

3 Rounding as required by reporting guidelines may result in apparent discrepancies between tonnes, grade, and contained metal content.

4 Mineral resources are not mineral reserves and do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

5 The estimate of mineral resources may be materially affected by geology, environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues, although there are currently no known factors related to these issues which could materially affect these mineral resource estimates.

The Updated MRE was prepared in accordance with Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards – For Mineral Resources and Mineral Reserves adopted by the CIM May 19, 2014, and in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). The Updated MRE was prepared by RESPEC Company LLC (formerly Mine Development Associates)(“RESPEC”) with an effective date of August 25, 2025.

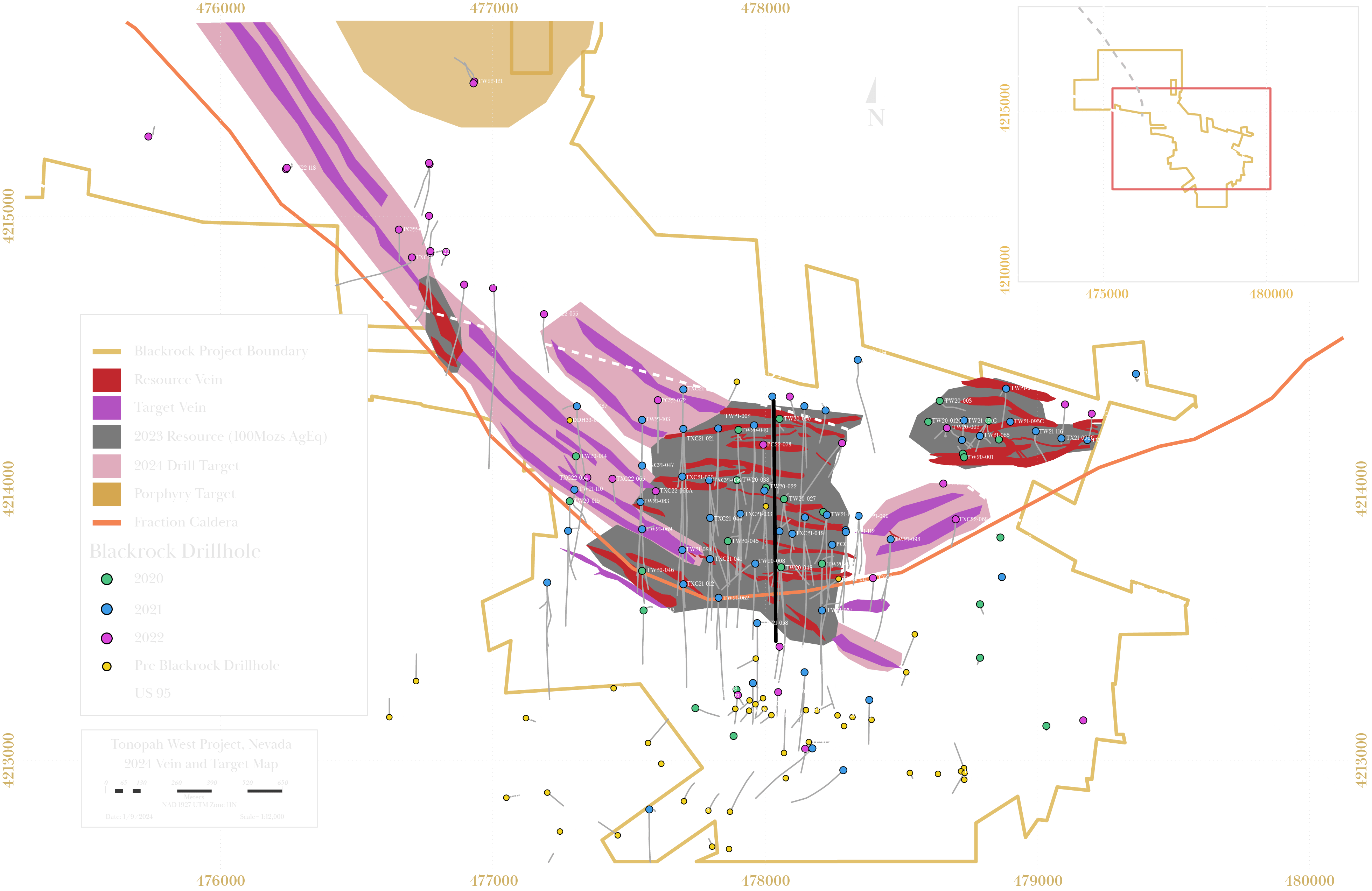

Claim Map

Amalgamation of West End Mining Company and Tonopah Extension Mining Company.

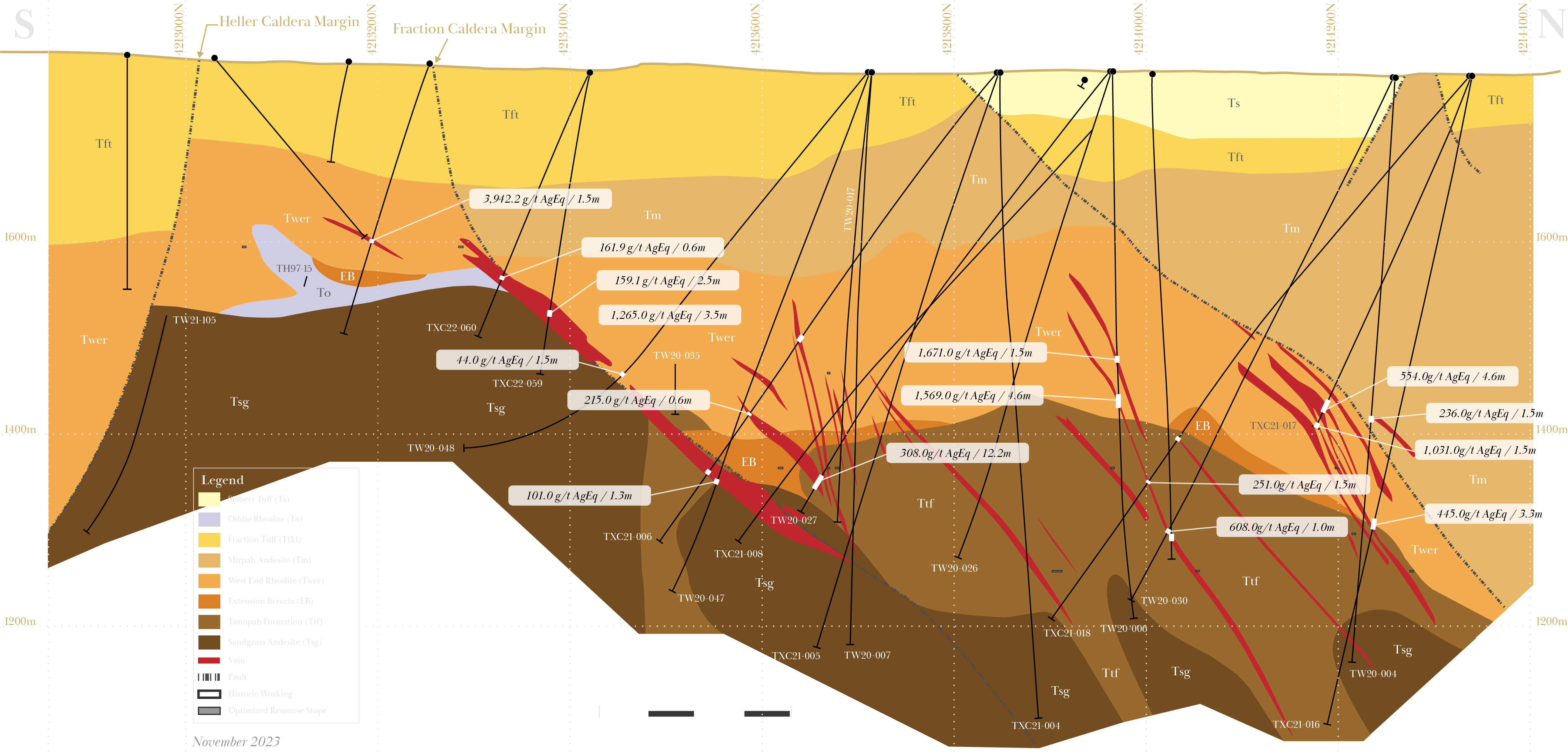

Cross Section - DPB Area

Multiple high-grade quartz vein swarm trending east-west to northwest.

System is open to the northwest with multiple new high-grade intercepts 1 km away.

Click image to expand

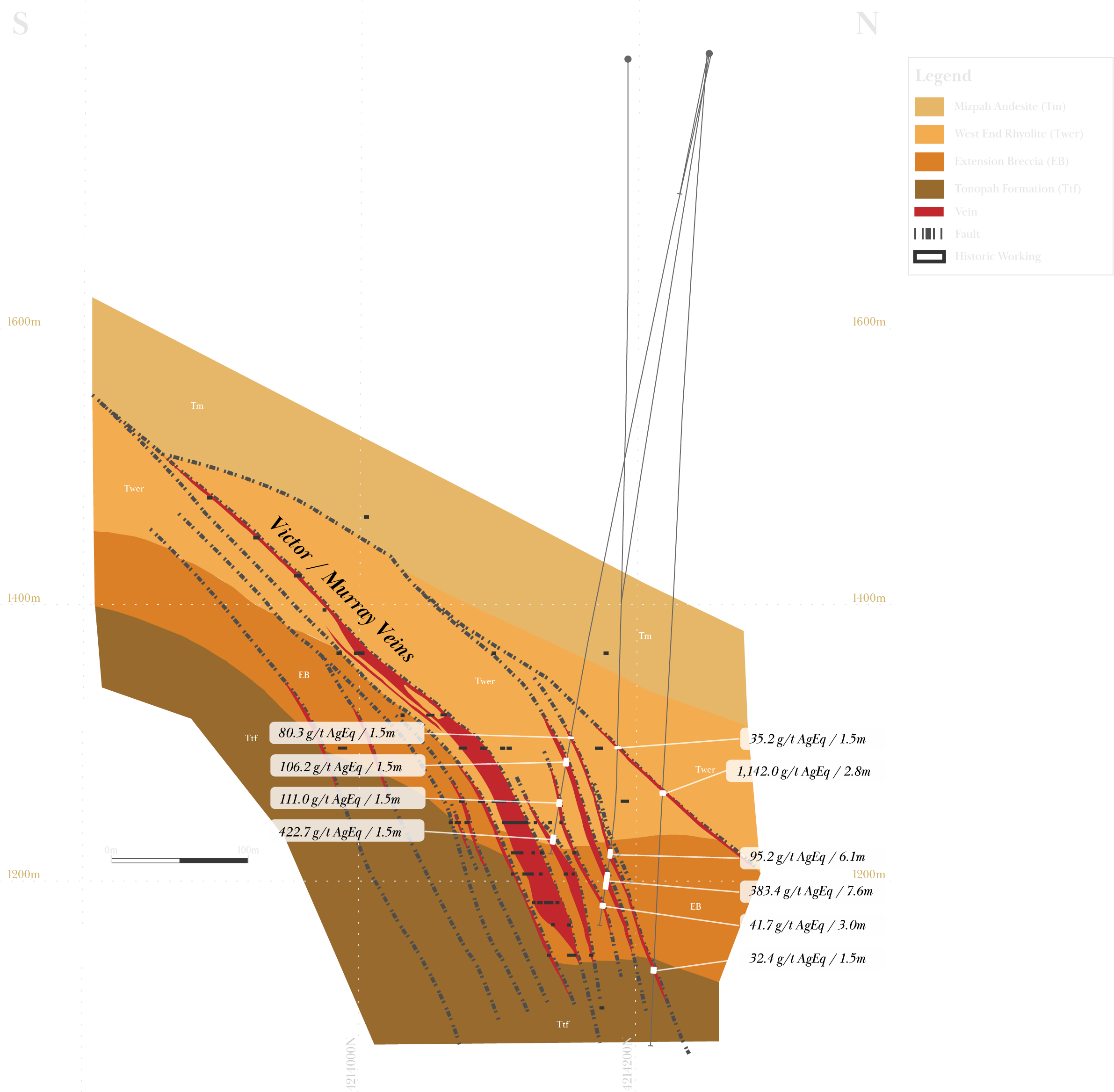

Cross Section - Victor Area

Silver Equivalent grade is based on silver and gold prices of US$20/ounce and US$1750/ounce,

respectively, and recoveries for silver and gold of 87% and 95%, respectively

Click image to expand

I, Jeffrey Bickel, C.P.G. (AIPG) and Registered Geologist (Arizona), consent to the public filing of the technical report titled “Technical Report for Updated Estimate of Mineral Resources, Tonopah West Silver-Gold Project, Nye and Esmeralda Counties, Nevada, USA”, with an effective date of October 6, 2023 and dated November 8, 2023 (the “Technical Report”) prepared for Blackrock Silver Corp. (the “Company”).

I also consent to any extracts from or a summary of the Technical Report in the news releases of the Company dated October 10, 2023 and November 8, 2023 (collectively, the “News Releases”).

I certify that I have read the News Releases filed by the Company and that they fairly and accurately represent the information in the Technical Report.

Dated this 8th day of November, 2023

“Jeffrey Bickel”//Sealed and Stamped

Jeffrey Bickel, C.P.G. (#12050)