May 12, 2022, ‑ Vancouver, British Columbia. Blackrock Silver Corp. (the “Company” or “Blackrock”) is pleased to report that the Company has commenced a fully funded 10,000 metre drill program on its Tonopah West project located in West Central Nevada along the Walker Lane gold and silver mineral belt. The project hosts a stope optimized inferred maiden resource estimate of 2.9 million tonnes at a block diluted grade of 208 grams per tonne (g/t) silver (Ag) and 2.5g/t gold (Au) for a total inferred mineral resource of 19,902,000 ounces Ag and 238,000 ounces Au, or 446 g/t silver equivalent (AgEq) for 42.6 million oz AgEq.[1] Silver equivalent grade is based on silver and gold prices of US$20/ounce and US$1750/ounce, respectively.

The program consists of reverse circulation (RC) pre-collars with core tails through known mineralized zones. Blackrock has laid out 10,000 metres of drilling with 2,500 metres allocated for step-out and resource expansion drilling and a further 7,500 metres focused on drilling out high-grade structures internal to the resource area.

Andrew Pollard, the Company’s President and CEO, stated, “Representing just 18 months of drilling data, baseline numbers from our maiden inferred resource estimate have established Tonopah West as one of the highest-grade undeveloped silver projects in the world[2], and we see significant opportunity for expansion, both within and external to the initial resource areas. With a refined model in hand, we have identified upside within the resource areas that should stand to benefit from additional drilling, targeting known, high-grade structures, in addition to infilling from successful step-out drillholes. Fully-financed for this program, drilling has commenced as we seek to grow our resource. We’ve seen remarkable return on investment via the drill bit thus far, with all-in discovery costs equating to US$0.62 per ounce AgEq. With less than two years of drilling at the project, it’s evident we’ve only just scratched the surface in realizing its true potential.”

Expansion drilling to the northwest of the DPB resource shows upside with the intersection of the Denver vein confirmed in drillholes TW22-119 and 120. A new core hole intercepted the Denver vein, assays pending, from 582 to 606 metres (1910 to 1988 feet) down the drillhole. The zone is significantly thicker than the mineralized vein encountered in TW22-119 and -120, and the core indicates the vein is dipping between 55 to 65 degrees to the north. The Denver vein is open to the northwest and approximately one kilometre to the southeast toward the DPB resource area. This discovery has the potential to double the strike length of the Denver vein and increase the resource of the DPB area.

In-fill drilling will focus on two areas within the DPB and along strike in the Victor resource. In DPB, drilling will connect the most western drill section with a zone encountered 260 metres to the west. High-grades in the Denver vein were encountered on cross section 477550E. As an example, drillhole TXC21-045 encountered 2.0 metres grading 3.64 g/t Au and 377.3 g/t Ag or 741.3 g/t AgEq. Drillhole TW21-110 encountered the Denver vein 262 metres to the west and returned 1.5 metres grading 1.46 g/t Au and 157.0 g/t Ag or 303.0 g/t AgEq. Three RC/core holes are planned for this area to connect strike extensions of the Denver vein and help to understand the high grade mineral trends within the veins.

On the south end of the DPB resource, the Denver and Merten veins intersect and form a thick zone of gold and silver mineralization. This area will be followed up with four RC/core drillholes. The mineralization starts within 200 metres of the surface.

On the east side of the DPB resource area, one drillhole will be completed to test the eastern extension of the Bermuda vein. The drillhole will be a 50 metre stepout along strike of the vein.

At Victor, four drillholes are planned to explore for footwall and hangingwall veins along the main silver-gold trend as well as to identify and capitalize on the high-grade nature of the mineralized vein shoots. These veins did not make the resource calculation because of their narrow geometry. The goal of the drilling will be to determine if mineralized shoots are present that have thicker and higher grade gold and silver within the veins.

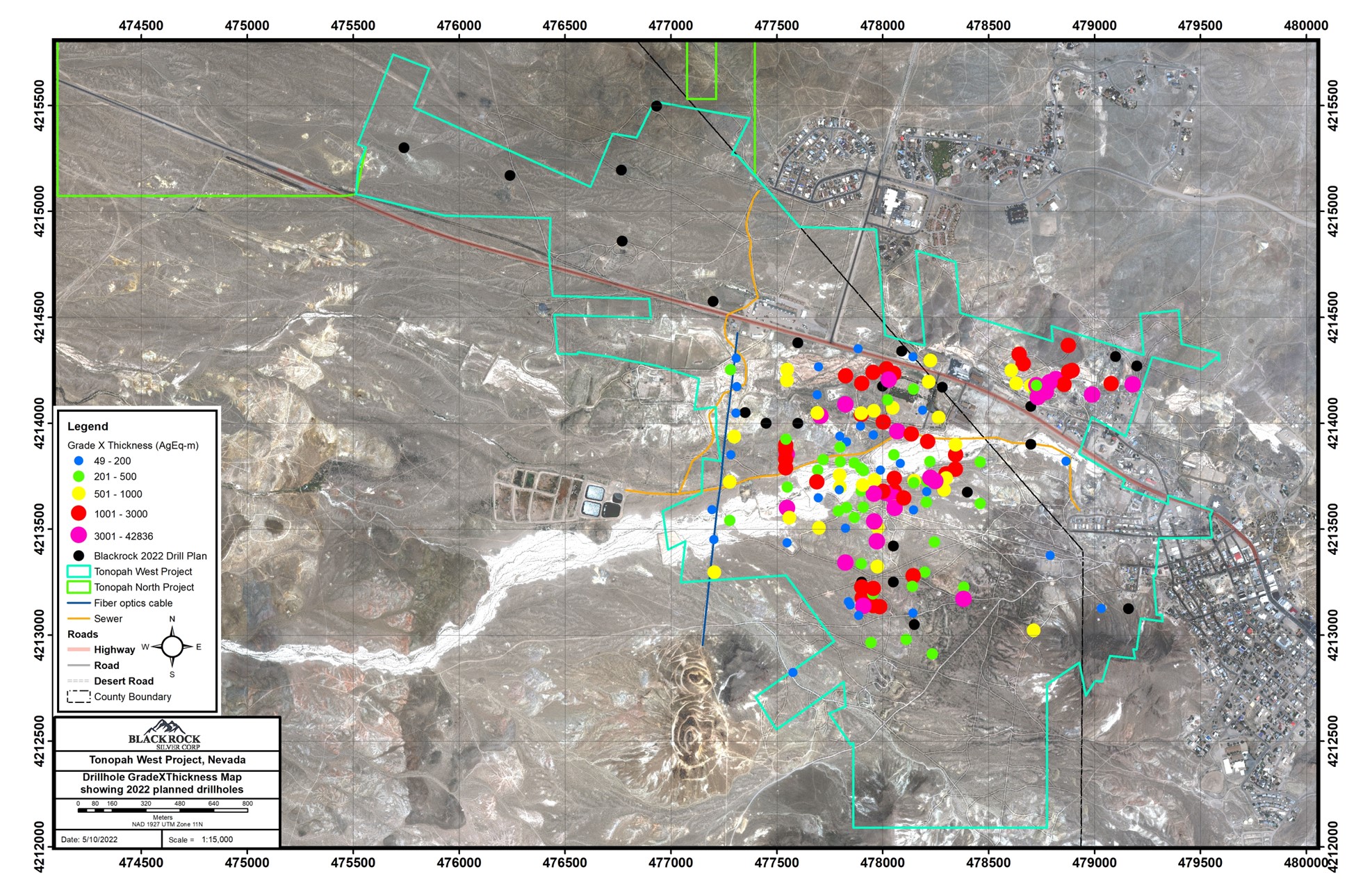

Figure 1 shows the distribution of in-fill and step-out drilling currently envisioned (Black Dots).

Blackrock’s exploration activities at the Tonopah West project are conducted and supervised by Mr. William Howald, Executive Chairman of Blackrock. Mr. William Howald, AIPG Certified Professional Geologist #11041, is a Qualified Person as defined under National Instrument 43-101. He has reviewed and approved the contents of this news release.

About Blackrock Silver Corp.

Blackrock is a junior precious metals focused exploration company that is on a quest to make an economic discovery. Anchored by a seasoned Board, the Company is focused on its Nevada portfolio of properties consisting of low-sulphidation epithermal gold & silver projects located along the established Northern Nevada Rift in north-central Nevada and the Walker Lane trend in western Nevada. Its flagship Tonopah West project hosts a stope optimized inferred maiden resource of 2.9 million tonnes grading at 446 g/t AgEq for 42.6 million oz AgEq.

For further information, please contact:

Andrew Pollard, President & CEO

Blackrock Silver Corp.

Phone: 604 817-6044

Email: andrew@blackrocksilver.com

Forward Looking Statements

This news release contains “forward-looking statements” within the meaning of Canadian securities legislation. Such forward‑looking statements concern the Company’s strategic plans, the maiden inferred resource estimate on the Tonopah West project, timing and expectations for the Company’s exploration and drilling programs, estimates of mineralization from drilling, geological information projected from sampling results and the potential quantities and grades of the target zones. Such forward‑looking statements or information are based on a number of assumptions, which may prove to be incorrect. Assumptions have been made regarding, among other things: conditions in general economic and financial markets; accuracy of assay results; geological interpretations from drilling results, and mineral resource estimates, timing and amount of capital expenditures; performance of available laboratory and other related services; future operating costs; and the historical basis for current estimates of potential quantities and grades of target zones. The actual results could differ materially from those anticipated in these forward‑looking statements as a result of risk factors, including the ability of the Company to make payments related to the lease option to purchase the Tonopah West project; the timing and content of work programs; results of exploration activities and development of mineral properties; the interpretation and uncertainties of drilling results and other geological data; receipt, maintenance and security of permits and mineral property titles; environmental and other regulatory risks; project costs overruns or unanticipated costs and expenses; availability of funds; failure to delineate potential quantities and grades of the target zones based on historical data, and general market and industry conditions. Forward-looking statements are based on the expectations and opinions of the Company’s management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made. The Company undertakes no obligation to update or revise any forward-looking statements included in this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

[1] News release dated May 2, 2022 titled “Blackrock Announces Tonopah West Maiden Stope Optimized Resource Estimate; 2.9 Million Tonnes Grading 446 g/t AgEq for 42.6 Million Ounces AgEq” for further information on the maiden resource estimate.

[2] Source: S&P Global; Company reports as of May 5, 2022. AgEq resources and grade reflect only silver and gold (M&I and I) resources (excludes base metals) for deposits larger than 40 million ounces AgEq.