Vancouver, British Columbia – May 23, 2023. Blackrock Silver Corp. (TSXV: BRC) (the “Company” or “Blackrock”) is pleased to announce that it has received approval from the Nevada Bureau of Land Management and finalized a drill agreement with Tonatec Exploration LLC to commence its Phase-1 drill program at the Company’s Silver Cloud property (“Silver Cloud”). Silver Cloud is located along the prolific, high-grade Northern Nevada Rift in north central Nevada adjacent to the Hollister mine and 15 kilometres south of the Midas mine.

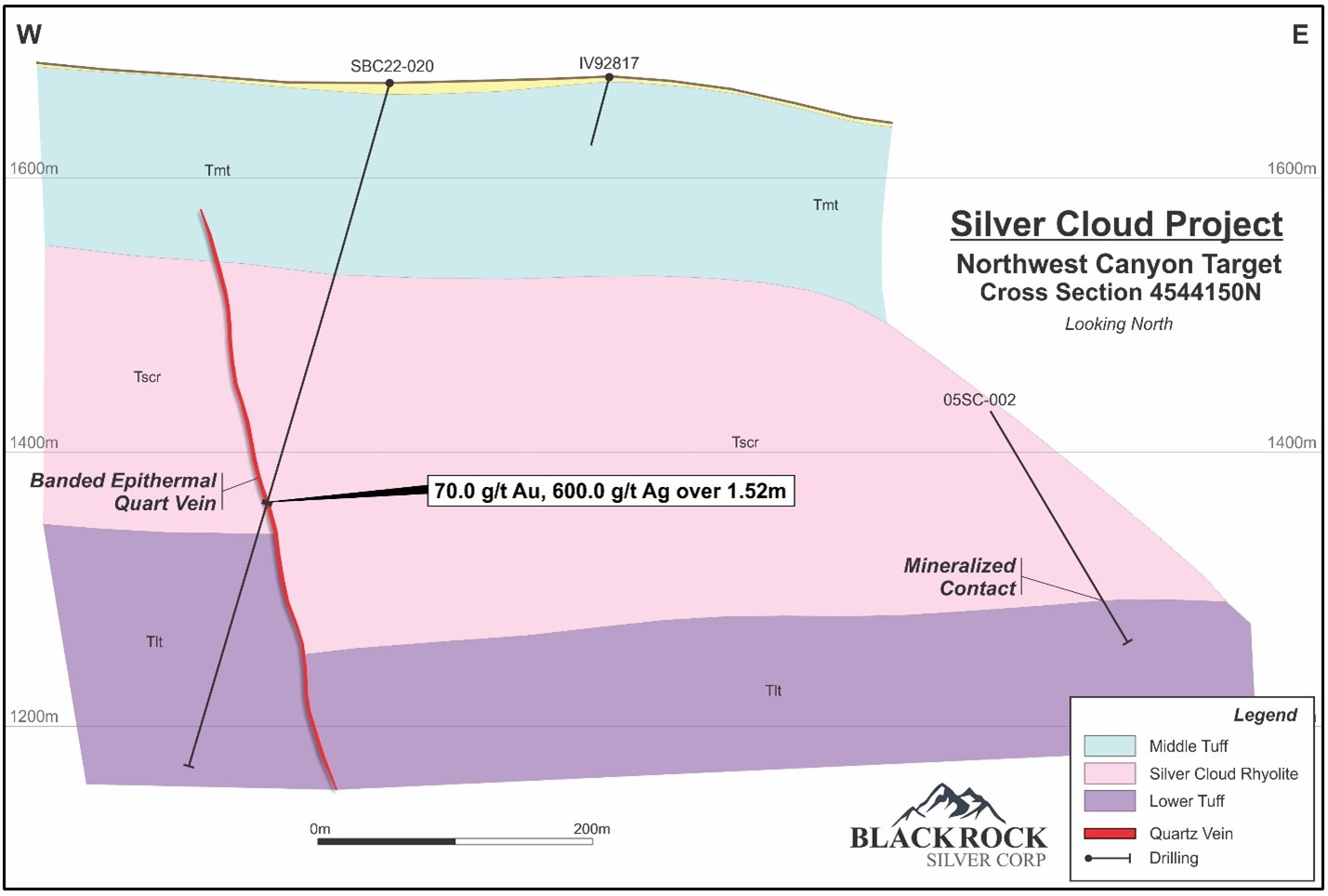

In January 2023, the Company confirmed its original bonanza-grade discovery intercept at the Northwest Canyon target with metallic-screen assay which returned 1.52 metres grading 70 g/t gold and 600 g/t silver in core hole SBC22-020 (see news releases dated December 7, 2022, and January 17, 2023). A severe winter in northern Nevada precluded immediate follow up on this bonanza-grade intercept.

With ground conditions improving, access to Silver Cloud has now been restored and equipment can now be mobilized to the property. The Phase-1 drill program at Silver Cloud is anticipated to start in early June 2023.

Andrew Pollard, President and Chief Executive Officer of the Company commented: “This bonanza-grade gold and silver discovery at the Northwest Canyon target is a potential game-changer for Blackrock Silver and we’ve been chomping at the bit to get back up there with the drills ever since. After what was a very severe winter in Nevada, the snow has finally melted and access has been regained allowing us to mobilize our equipment and commence drilling in June, giving Blackrock the opportunity to finally walk this new exciting discovery forward with this fully-funded program.”

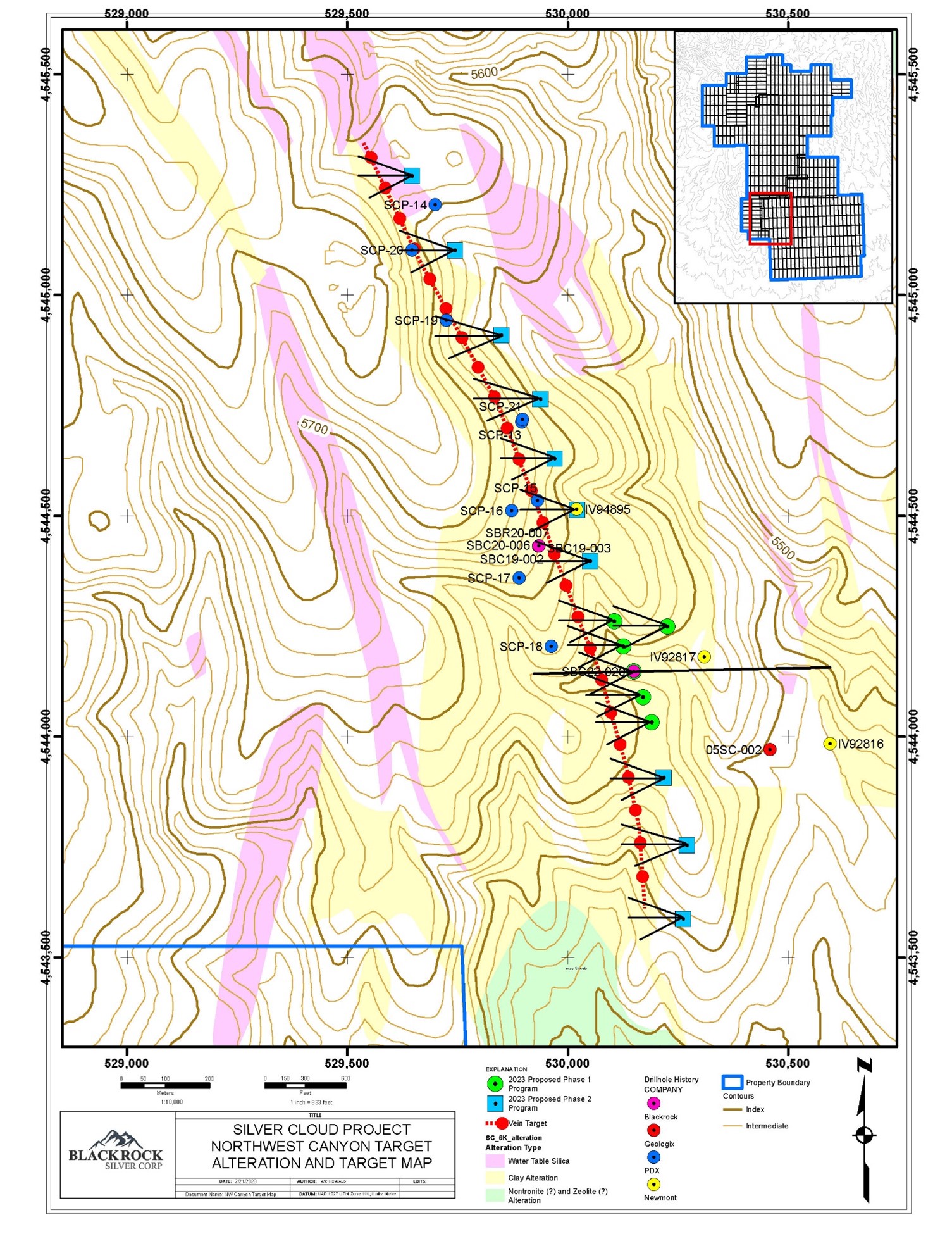

Pollard continued, “Nestled along the Northern Nevada Rift, in between and on trend of two of Nevada’s highest-grade historic gold mines, the Silver Cloud property holds tremendous potential in what may be the missing link of what is one big, high-grade system. In January 2023, we reported the highest-grade intercept we’ve had as a Company in making this new discovery, intersecting 1.52 meters grading 70 g/t gold and 600 g/t silver in core hole SBC22-020 in Northwest Canyon. Based on the historic drill data which has assays of 5.61 g/t gold over 12.2 meters, the Company believes the vein could extend up to 2 kilometers along a north-northwest orientation. This Phase-1 program will test an initial 500 metres of that strike potential.”

The initial Phase-1 program will commence with 2,200 metres of drilling for approximately 500 metres of strike along the Northwest Canyon vein projection. The vein does not outcrop at the surface and is hosted within the porphyritic Silver Cloud Rhyolite volcanic unit. Based on data from previous historic drilling in the target area, including a drill intercept in SCP-15 of 12.2 metres grading 5.61 g/t gold, the Company believes the vein could have as many as 2 kilometres of strike length along a north-northwest orientation.

Quality Assurance/ Quality Control

All sampling is conducted under the supervision of the Company’s project geologists, and a strict chain of custody from the project to the sample preparation facility is implemented and monitored. The core samples are hauled from the project site to a secure and fenced facility in Battle Mountain, Nevada, where they are loaded on to American Assay Laboratory’s (AAL) flat-bed truck and delivered to AAL’s facility in Sparks, Nevada. A sample submittal sheet is delivered to AAL personnel who organize and process the sample intervals pursuant to the Company’s instructions.

The core and QA/QC samples are crushed and pulverized, then the pulverized material is digested and analyzed for Au using fire assay fusion and an Induced Coupled Plasma (ICP) finish on a 30-gram assay split. Silver is determined using five-acid digestion and ICP analysis. Over limits for gold and silver are determined using a gravimetric finish. Data verification of the assay and analytical results are completed to ensure accurate and verifiable results. Blackrock personnel insert a blind prep blank, lab blank or certified reference material approximately every 15th to 20th sample. In addition, a random selection of pulps are sent to ALS Minerals in Reno, Nevada, for check assays.

Blackrock’s exploration activities at Silver Cloud are conducted and supervised by Mr. William Howald, Executive Chairman of Blackrock. Mr. William Howald, AIPG Certified Professional Geologist #11041, is a Qualified Person as defined under National Instrument 43-101. He has reviewed and approved the contents of this news release.

Blackrock Silver to Present at Gravitas’ 4th Los Angeles Summit

Blackrock Silver is pleased to announce it will be presenting at Gravitas’ 4th Los Angeles Summit, which will be taking place at The Beverly Hills Hotel from Sunday, June 4th to Tuesday, June 6th, 2023, in Beverly Hills, California.

Andrew Pollard, President, and Chief Executive Officer, is scheduled to present on Monday, June 5th, 2023, at 11 am PDT, where he will also be fielding investor questions during the in-person summit.

Gravitas’ 4th Los Angeles Summit will feature public and private companies across various industries presenting to a highly selective audience of venture capital, family office, and institutional investors attending from Canada, the United States, and abroad. We also welcome any investors from the Southern California area to register to attend.

For registration details, please visit: https://www.eventbrite.com/e/gravitas-securities-4th-annual-la-summit-tickets-581002142047?aff=eemailordconf&utm_campaign=order_confirm&ref=eemailordconf&utm_medium=email&utm_source=eventbrite&utm_term=viewevent

Summit Details:

Event: Gravitas’ 4th Los Angeles Summit

Format: Presentations and Q&A

Presentation Dates: Monday, June 5th and Tuesday, June 6th, 2023

Time: 9:00 AM PDT – 4:00 PM PDT

Venue: In-person at The Beverly Hills Hotel

About Blackrock Silver Corp.

Backed by gold and silver ounces in the ground, Blackrock is a junior precious metal focused exploration company driven to add shareholder value via the drill bit. With 2.97 million tonnes grading 446 g/t silver equivalent[1] at its Tonopah West project, and a new bonanza-grade gold discovery at Silver Cloud, the Company has a proven track record of exploration success. In addition to its gold and silver project portfolio, the Company is credited with a lithium discovery, the Tonopah North project, which is under option to a major lithium exploration group. Anchored by a seasoned Board, the Company is focused on its 100% controlled Nevada portfolio of properties consisting of low-sulphidation, epithermal gold and silver mineralization located along the established Northern Nevada Rift in north-central Nevada and the Walker Lane trend in western Nevada.

For further information, please contact:

Andrew Pollard, President & CEO

Blackrock Silver Corp.

Phone: 604 817-6044

Email: andrew@blackrocksilver.com

Forward Looking Statements

This news release contains “forward-looking statements” within the meaning of Canadian securities legislation. Such forward-looking statements concern, but are not limited to: the Company’s strategic plans; timing and expectations for the Company’s exploration and drilling programs, including the Phase-1 drilling program at Silver Cloud; estimates of mineralization from drilling; geological information projected from sampling results; and the potential quantities and grades of the target zones. Such forward-looking statements or information are based on a number of assumptions, which may prove to be incorrect. Assumptions have been made regarding, among other things: conditions in general economic and financial markets; accuracy of assay results; geological interpretations from drilling results, timing and amount of capital expenditures; performance of available laboratory and other related services; future operating costs; and the historical basis for current estimates of potential quantities and grades of target zones. The actual results could differ materially from those anticipated in these forward-looking statements as a result of risk factors, including but not limited to: the timing and content of work programs; results of exploration activities and development of mineral properties; the interpretation and uncertainties of drilling results and other geological data; receipt, maintenance and security of permits and mineral property titles; environmental and other regulatory risks; project costs overruns or unanticipated costs and expenses; availability of funds; failure to delineate potential quantities and grades of the target zones based on historical data; and general market and industry conditions. Forward-looking statements are based on the expectations and opinions of the Company’s management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made. The Company undertakes no obligation to update or revise any forward-looking statements included in this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

[1] Technical information relating to the Tonopah West project is based on and derived from the NI 43-101 report prepared for Blackrock entitled “Technical Report and Estimate of Mineral Resources for the Tonopah West Silver-Gold Project, Nye and Esmeralda Counties, Nevada, USA” effective April 28, 2022 authored by Michael S. Lindholm, C.P.G. and Jeffrey Bickel, C.P.G. (the “Technical Report”). The Technical Report outlines 2.97million tonnes at a block diluted grade of 208 grams per tonne (g/t) silver (Ag) and 2.5g/t gold (Au) for a total inferred mineral resource of 19,902,000 ounces Ag and 238,000 ounces Au, or 446 g/t silver equivalent (AgEq) for 42.6million oz AgEq. AgEq equivalent grade is based on silver and gold prices of US$20/ounce and US$1750/ounce, respectively, and recoveries for silver and gold of 87%and 95%