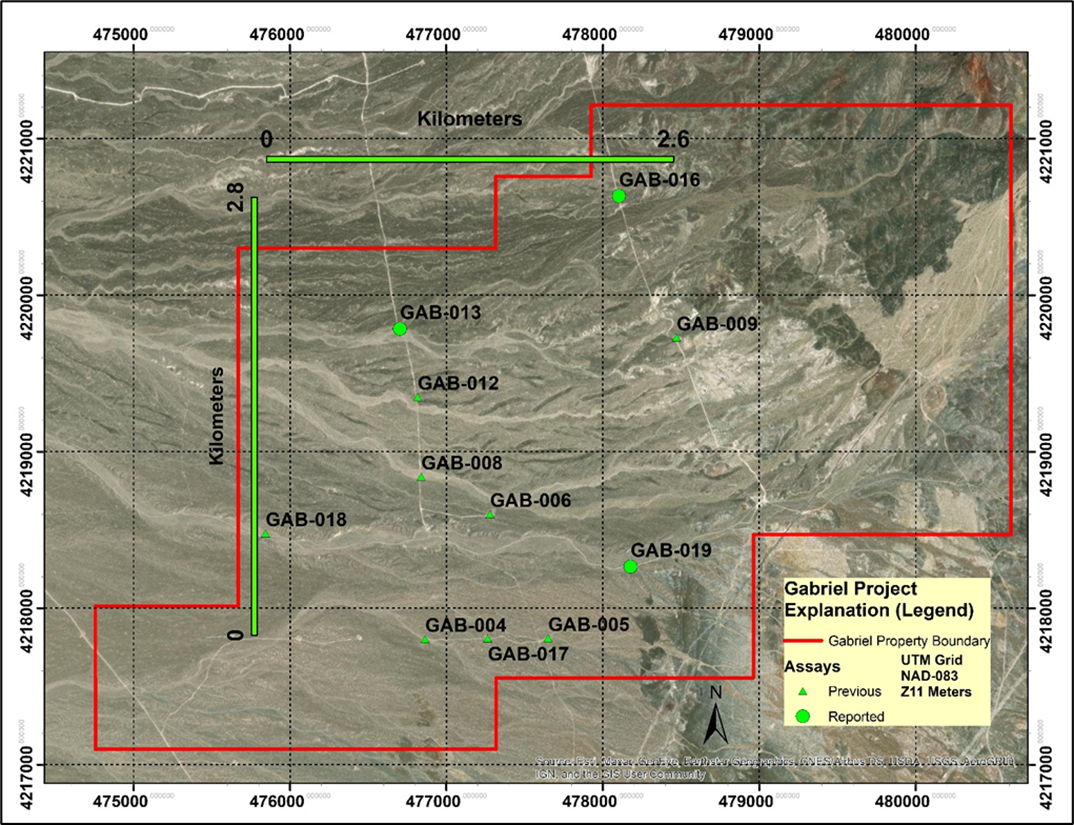

Vancouver, British Columbia – May 18, 2023. Blackrock Silver Corp. (TSXV:BRC) (the “Company” or “Blackrock”) is pleased to announce that Tearlach Resources Ltd. (“Tearlach”) has reported assay results for three (3) new core step-out drill holes (GAB-013, 016, & 019) at the Company’s Tonopah North Lithium Project (“Gabriel”) in Tonopah, Nevada. These newly reported holes intersected broad lithium-mineralized zones with many intervals exceeding 1,000 ppm and grades up to 1,300 ppm. With all results received and reported from the Phase 1, 11 core drillhole program, Tearlach intersected significant grade and thickness of lithium mineralization in every drillhole. Assays show higher than expected lithium values as compared to the original discovery drilling and have established an expanded mineralized blanket covering an area 2.6 km by 2.8 km or 7.3 square kilometres. Based on Tearlach’s results, the zone appears to be open to the north, south and west.

Andrew Pollard, President and Chief Executive Officer of Blackrock, commented: “With each drillhole from our partner-funded Phase-1 core program hitting broad, thick zones of mineralization across a 7.3 square kilometre area, the results signal significant tonnage potential, with a grade profile that is in line with other more advanced projects on the Tonopah Lithium belt, including the adjacent TLC deposit (owned by American Lithium Corp). The project has come a long way since the initial discovery was made less than one year ago by Blackrock, and we’re excited for Tearlach to get geologic modelling of the data underway on this largely open system. With both silver and lithium to play crucial roles within the emerging green economy, the Company’s landholdings in Tonopah, complete with one of the highest-grade undeveloped silver/gold resources in the world, in addition to the adjacent lithium discovery quickly being advanced, uniquely position Blackrock as a potential domestic provider of these critical metals.”

The following data was reported for the Gabriel project in the May 17, 2023 news release issued by Tearlach (the “Tearlach Release”):

Highlights:

Table 1 is a compilation of all Phase-1 core drillholes. Each hole intersected a zone of lithium mineralization, at a cut-off grade of 400 parts per million (ppm). Primary intercept grades range between 535 to 802 ppm and interval lengths between 27.1 (8.4m) to 146.6 feet (44.7m). The Phase-1 program has been drilled within a general area of 8,530 feet (2.6 km) by 9,190 feet (2.8 km).

Table 1: Consolidated Lithium results for Tonopah North (Grabriel) using a 400 ppm Li cut off

| Gabriel Phase 1 Consolidated Lithium Results | |||||||

| Hole ID | From (ft) | To (ft) | Interval (ft) | From (m) | To (m) | Interval (m) | Li (ppm) |

| GAB-004 | 118.2 | 145.3 | 27.1 | 36.0 | 44.3 | 8.3 | 703 |

| Including | 142.9 | 145.3 | 2.4 | 43.6 | 44.3 | 0.7 | 1,060 |

| GAB-005 | 251.4 | 345.6 | 94.2 | 76.6 | 105.3 | 28.7 | 541 |

| Including | 258.5 | 276.1 | 17.6 | 78.8 | 84.2 | 5.4 | 860 |

| Including | 274.2 | 276.1 | 1.9 | 83.6 | 84.2 | 0.6 | 1,390 |

| GAB-006 | 80.5 | 119.4 | 38.9 | 24.5 | 36.4 | 11.9 | 401 |

| GAB-006 | 164.1 | 242.0 | 77.9 | 50.0 | 73.8 | 23.7 | 707 |

| Including | 182.6 | 220.0 | 37.4 | 55.7 | 67.1 | 11.4 | 939 |

| Including | 191.5 | 217.0 | 25.5 | 58.4 | 66.1 | 7.8 | 1,018 |

| Including | 199.2 | 204.5 | 5.3 | 60.7 | 62.3 | 1.6 | 1,220 |

| GAB-008 | 206.0 | 333.0 | 127.0 | 62.8 | 101.5 | 38.7 | 574 |

| Including | 314.2 | 318.5 | 4.3 | 95.8 | 97.1 | 1.3 | 1,310 |

| GAB-009 | 24.0 | 170.6 | 146.6 | 7.3 | 52.0 | 44.7 | 662 |

| Including | 134.4 | 170.6 | 36.2 | 41.0 | 52.0 | 11.0 | 879 |

| Including | 147.4 | 154.4 | 7.0 | 44.9 | 47.1 | 2.1 | 1,030 |

| GAB-012 | 184.0 | 315.0 | 131.0 | 56.1 | 96.0 | 39.9 | 658 |

| Including | 281.7 | 315.0 | 33.3 | 85.9 | 96.0 | 10.1 | 1,196 |

| Including | 287.6 | 296.5 | 8.9 | 87.7 | 90.4 | 2.7 | 1,460 |

| GAB-013 | 133.2 | 249.1 | 115.9 | 40.6 | 75.9 | 35.3 | 645 |

| Including | 214.0 | 249.1 | 35.1 | 65.2 | 75.9 | 10.7 | 914 |

| Including | 221.8 | 228.1 | 6.3 | 67.6 | 69.5 | 1.9 | 1,300 |

| GAB-016 | 76.0 | 164.0 | 88.0 | 23.2 | 50.0 | 26.8 | 495 |

| Including | 87.0 | 94.0 | 7.0 | 26.5 | 28.7 | 2.1 | 830 |

| GAB-017 | 149.8 | 192.0 | 42.2 | 45.7 | 58.5 | 12.9 | 695 |

| Including | 171.7 | 173.5 | 1.8 | 52.3 | 52.9 | 0.5 | 1,410 |

| GAB-018 | 119.8 | 180.2 | 60.4 | 36.5 | 54.9 | 18.4 | 535 |

| GAB-018 | 239.0 | 300.0 | 61.0 | 72.8 | 91.4 | 18.6 | 802 |

| Including | 287.0 | 292.0 | 5.0 | 87.5 | 89.0 | 1.5 | 1,340 |

| GAB-019 | 271.2 | 333.0 | 61.8 | 82.7 | 101.5 | 18.8 | 549 |

| GAB-019 | 354.2 | 401.9 | 47.7 | 108.0 | 122.5 | 14.5 | 729 |

| Including | 374.3 | 401.9 | 27.6 | 114.1 | 122.5 | 8.4 | 879 |

| Including | 398.0 | 401.9 | 3.9 | 121.3 | 122.5 | 1.2 | 1,100 |

Lithium mineralization has consistently been intersected in the lower portion of the Siebert Formation. A second zone of mineralization has also been intersected in some holes, present in the upper portion of the Siebert. The lithium mineralization is hosted in a claystone-siltstone-sandstone-conglomerate sedimentary sequence.

Faults, with a normal sense of offset, have been mapped on the Gabriel surface. Fault-broken zones, gouge and cataclasites have also been logged in the core. The location and orientation of these structures will be assessed during the upcoming three-dimensional (3D) geologic modeling project.

Every twin core hole drilled in the Phase-1 Program returned intercept values higher (range of 36 – 85%) than the corresponding Blackrock Silver (BRS) TN22 reverse-circulation rotary hole. Based on Tearlach’s expertise, a total of 603 TN22 drillhole pulps have been collected and submitted for lithium re-assay.

Full details of the results outlined in this news release can be seen in the Tearlach Release, inclusive of QA/QC procedures and approval by a Qualified Person (as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects).

| Gabriel Collar Data, All Drillholes To Date | |||||

| UTM NAD83 | |||||

| Hole | Easting | Northing | Elevation, m | Azimuth | Dip |

| GAB-004 | 476,868 | 4,217,803 | 1739.2 | 0 | -90 |

| GAB-005 | 477,646 | 4,217,808 | 1761.7 | 0 | -90 |

| GAB-006 | 477,279 | 4,218,601 | 1749.6 | 0 | -90 |

| GAB-008 | 476,848 | 4,218,837 | 1739.5 | 0 | -90 |

| GAB-009 | 478,477 | 4,219,723 | 1798.3 | 0 | -90 |

| GAB-012 | 476,822 | 4,219,342 | 1739.2 | 0 | -90 |

| GAB-013 | 476,703 | 4,219,784 | 1739.5 | 0 | -90 |

| GAB-016 | 478,116 | 4,220,634 | 1803.2 | 0 | -90 |

| GAB-017 | 477,268 | 4,217,813 | 1751.4 | 0 | -90 |

| GAB-018 | 475,854 | 4,218,492 | 1705.1 | 0 | -90 |

| GAB-019 | 478,183 | 4,218,256 | 1768.4 | 0 | -90 |

Blackrock and Tearlach are parties to an option agreement dated January 10, 2023 (the “Option Agreement”) wherein, among other things, Blackrock has granted Tearlach an option to acquire, in two stages, up to a 70% interest in the lithium minerals in certain unpatented mining claims forming a portion of Gabriel. Upon incurring exploration expenditures of US$5,000,000 within three years, Tearlach will have earned a 51% interest in Gabriel, and upon incurring cumulative exploration expenditures of US$15,000,000 and completion of a Feasibility study within 5 years, Tearlach will have earned a 70% interest. Pursuant to the Option Agreement, Tearlach has the exploration rights from surface to 650 feet (200 metres) below the topographic surface to explore for lithium. Blackrock retains the rights to all other minerals including gold and silver at Gabriel.

About Blackrock Silver Corp.

Backed by gold and silver ounces in the ground, Blackrock is a junior precious metal focused exploration company driven to add shareholder value via the drill bit. With 2.97 million tonnes grading 446 g/t silver equivalent[1] at its Tonopah West project, and a new bonanza-grade gold discovery at Silver Cloud, the Company has a proven track record of exploration success. In addition to its gold and silver project portfolio, the Company is credited with a lithium discovery, the Tonopah North project, which is under option to a major lithium exploration group. Anchored by a seasoned Board, the Company is focused on its 100% controlled Nevada portfolio of properties consisting of low-sulphidation, epithermal gold and silver mineralization located along the established Northern Nevada Rift in north-central Nevada and the Walker Lane trend in western Nevada.

For further information, please contact:

Andrew Pollard, President & CEO

Blackrock Silver Corp.

Phone: 604 817-6044

Email: andrew@blackrocksilver.com

Forward Looking Statements

This news release contains “forward-looking statements” within the meaning of Canadian securities legislation. Such forward‑looking statements concern, without limitation, the Option Agreement with Tearlach and the exercise of the options by Tearlach pursuant thereto, the entering into a joint venture between the Company and Tearlach, Tearlach’s statements as to its exploration and development plans, the role of silver and lithium in the emerging green economy, the Company’s strategic plans, timing and expectations for the Company’s exploration and drilling programs, estimates of mineralization from drilling, geological information projected from sampling results and the potential quantities and grades of the target zones. Such forward‑looking statements or information are based on a number of assumptions, which may prove to be incorrect. Assumptions have been made regarding, among other things: conditions in general economic and financial markets; accuracy of assay results; geological interpretations from drilling results, timing and amount of capital expenditures; performance of available laboratory and other related services; future operating costs; and the historical basis for current estimates of potential quantities and grades of target zones. The actual results could differ materially from those anticipated in these forward‑looking statements as a result of risk factors, including the timing and content of work programs; results of exploration activities and development of mineral properties; the interpretation and uncertainties of drilling results and other geological data; receipt, maintenance and security of permits and mineral property titles; environmental and other regulatory risks; project costs overruns or unanticipated costs and expenses; availability of funds; failure to delineate potential quantities and grades of the target zones based on historical data, and general market and industry conditions. Forward-looking statements are based on the expectations and opinions of the Company’s management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made. The Company undertakes no obligation to update or revise any forward-looking statements included in this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

[1] Technical information relating to the Tonopah West project is based on and derived from the NI 43-101 report prepared for Blackrock entitled “Technical Report and Estimate of Mineral Resources for the Tonopah West Silver-Gold Project, Nye and Esmeralda Counties, Nevada, USA” effective April 28, 2022 (the “Technical Report”). The Technical Report outlines 2.97million tonnes at a block diluted grade of 208 grams per tonne (g/t) silver (Ag) and 2.5g/t gold (Au) for a total inferred mineral resource of 19,902,000 ounces Ag and 238,000 ounces Au, or 446 g/t silver equivalent (AgEq) for 42.6million oz AgEq. AgEq equivalent grade is based on silver and gold prices of US$20/ounce and US$1750/ounce, respectively, and recoveries for silver and gold of 87%and 95%